Present value of annuity chart

PV FV 1 i n. Financial Statements of a Corporation The main financial statements of a corporation are.

Present Value Of Ordinary Annuity Principlesofaccounting Com

The value of your annuity is essentially the amount of money you would receive if you were to liquidate the asset.

. After the date of your first payment you cannot change your selection. Calculating the present value of an annuity using Microsoft Excel is a fairly straightforward exercise. 2007-Present Actuarial value of annuity is converted to account balance and moved to UMPIP upon withdrawal via 360 Life annuity based on denominational average compensation DAC in year of discontinuance available at age 62 or later No impact.

The corporate income tax raised 2302 billion in fiscal 2019 which accounted for 66 percent of total federal revenue and had seen a change from 9 percent in 2017. On the other hand IRR ie. You can buy the annuity plan as early as possible like at the age of 45 or 50 years after knowing the present value of annuity and start availing of the benefits possibly.

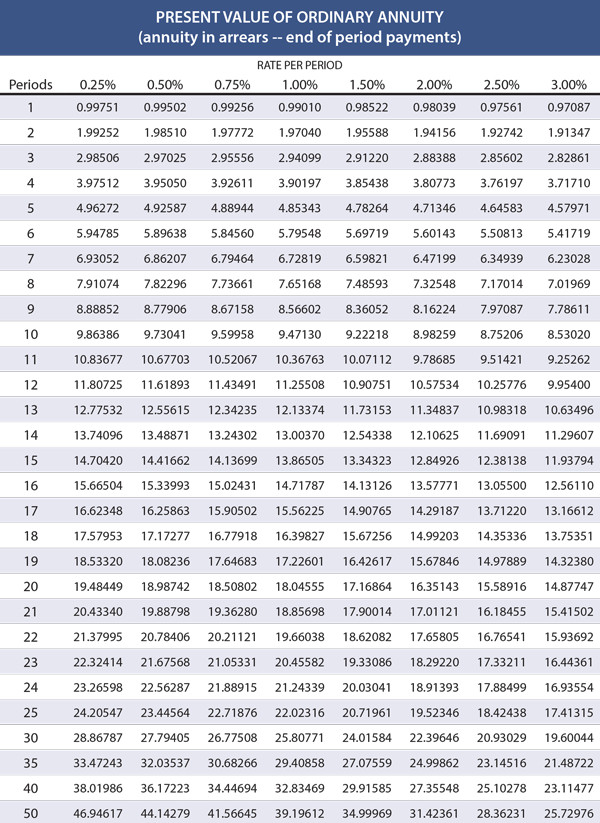

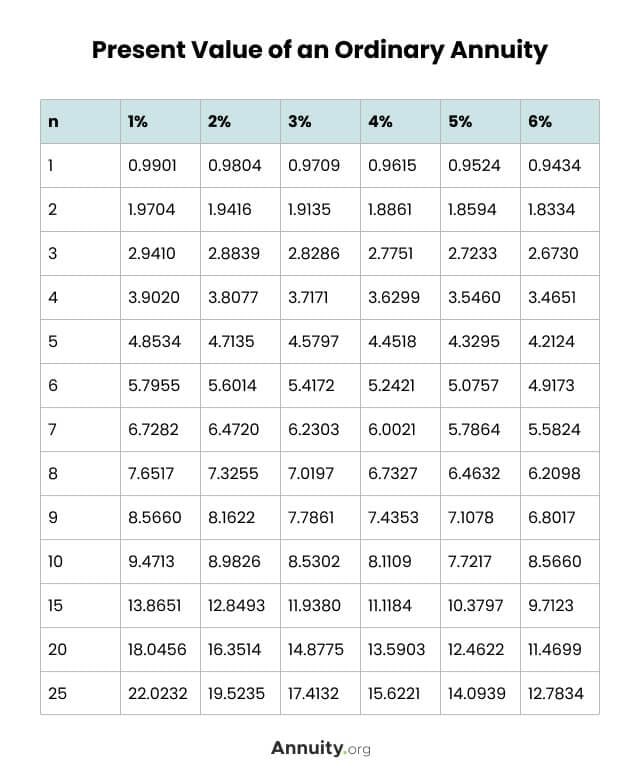

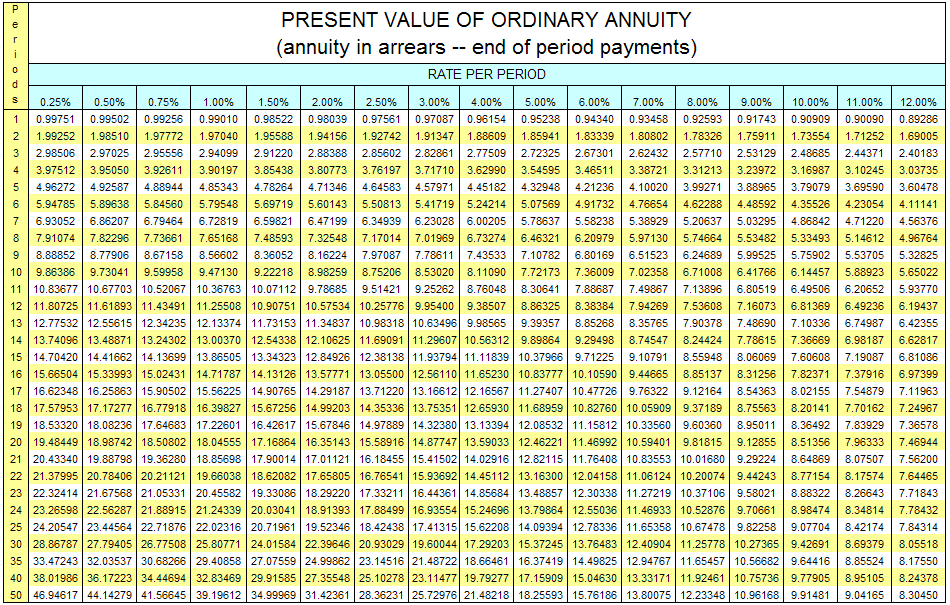

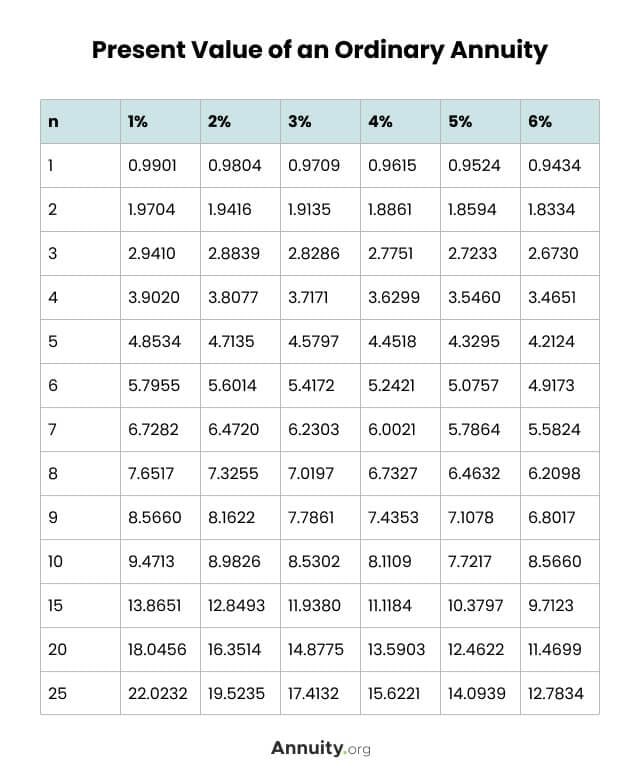

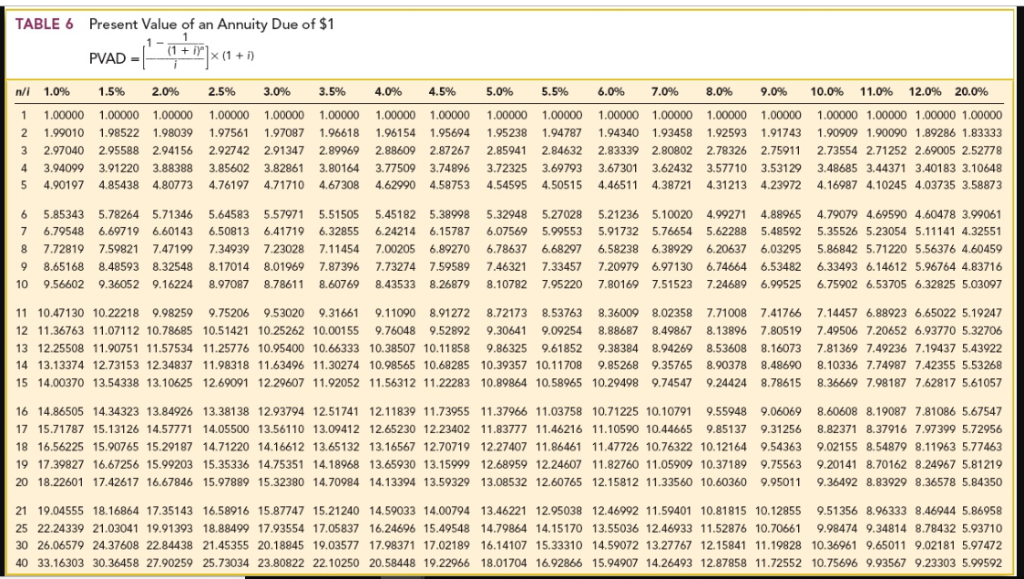

Find the Tab that You Need for Macros VBA and More. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Present value annuity tables are used to provide a solution for the part of the present value of an annuity formula shown in red this is sometimes referred to as the present value annuity factor.

This can be useful to understand when the annuitys rate of return. What is the present value of 5000 received at the end of each year for. Allocation based on fair market value of.

The word project comes from the Latin word projectum from the Latin verb proicere before an action which in turn comes from pro- which denotes precedence something that comes before something else in time paralleling the Greek πρό and iacere to doThe word project thus originally meant before an action. When the English language initially adopted. The following summarizes for easy reference the formulas for calculating present value of future payments future value of lump.

An Annuity Due see Fig 3 is one in which the payments are made at the beginning of each period. The discount varies from company to company but it is based on the present-value formula and the concept of time value of money. Get 247 customer support help when you place a homework help service order with us.

The future value of an annuity formula is. Atal Pension Yojana Premium Chart. To calculate the present value of receiving 1000 at the end of 20 years with a 10 interest rate insert the factor into the formula.

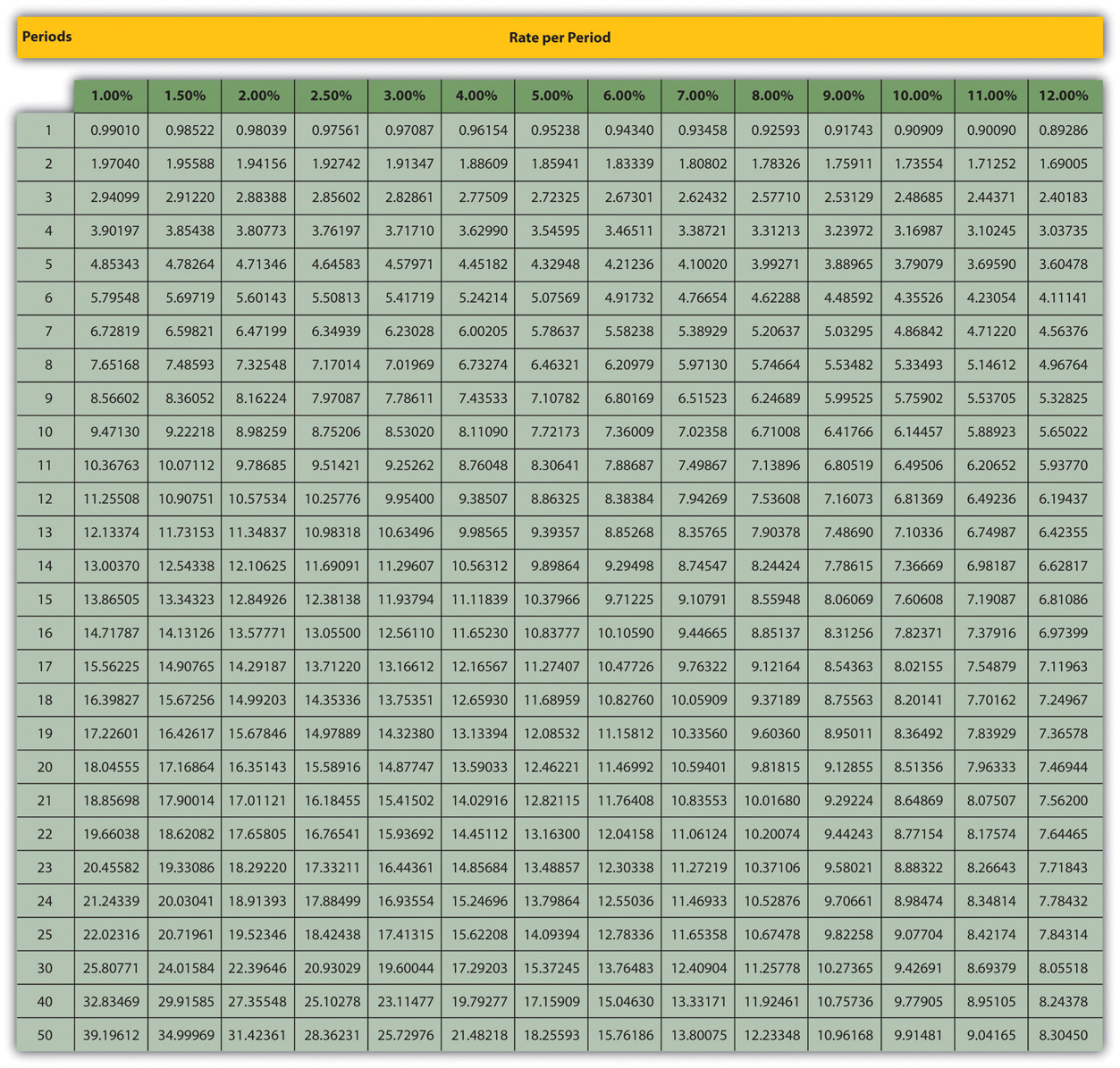

Examples of annuities due might be deposits in savings retirement. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. They provide the value at the end of period n of 1 received at the end of each period for n periods at a discount rate of i.

Atal Pension Yojana APY is a. PV FV x 1 1 i n. This is the present value of annuity formula.

Using the formula to determine the present value we have. The purpose of the present value tables is to make it possible to carry out present value calculations without the use of a financial calculator. NPV or otherwise known as Net Present Value method reckons the present value of the flow of cash of an investment project that uses the cost of capital as a discounting rate.

Definition of Dividends Cash dividends are a distribution of a companys profits. Be present in the United States for at least 75 of the number of days beginning with the first day of the 31-day period and ending with the last day of 2021. For purposes of this 75 requirement you can treat up to 5 days of absence from the United States as days of presence in the United States.

Annuity Rate of Return - A line chart that displays the rate of return from the annuity over time. The present rate of tax on corporate income was adopted in the Tax Reform Act of 1986. Life annuity continues unchanged Ministerial Pension Plan MPP 1982-2006.

All other benefits are paid as a monthly annuity. A PV is the more accepted way to calculate the value of an annuity. After 2 years the value of the lump sum would be 105 105 100.

I went the other way and inputted 678000 present value 33 years and 3 annual growth to equal 1800000. This is the present value of annuity formula. The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for a.

PBGC pays lump sums only when a total benefit has a value of 5000 or less. In this example the 11025 is the future value of the lump sum and the 100 is the present value of the lump sum at 5 for 2 years. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The present value formula is. Present Value Interest Factor of Annuity PVIFA Present Value Interest Factor of Annuity ie PVIFA is an element used to estimate the current value of a sequence of the annuity payments. Here we present the 2019 period life table for the Social Security area population as used in the 2022 Trustees Report TRFor this table the period life expectancy at a given age is the average remaining number of years expected prior to death for a person at that exact age.

For more information about PBGC benefit options see. The purpose of the future value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. Excel can perform complex finance and banking calculations including annuity calculations.

Internal rate of return is a rate of interest which matches present value of future cash flows with the initial capital outflow. Lets use the following formula to compute the present value of the maturity amount only of the bond described above. FV Pmt x 1 i n - 1 i.

The annuity represented in figure 1 is called an Ordinary Annuity or an annuity in which the payments are made at the end of each periodMonthly mortgage payments are an example of an ordinary annuity. Income statement statement of comprehensive income balance sheet statement of cash flows statement of stockholders equity Wh. If the chart is hard to read please right-click and choose view image.

Calculation Using a PV of 1 Table Use the PV of 1 table to find the rounded present value factor at the intersection of n 20 and i 10. The commencing payment earns interest at a specific rate r above a series of periods for the. PV Pmt x Present value annuity factor Present Value Annuity Table Example.

A period life table is based on the mortality experience of a population during a relatively short period of time. Visually Display Composite Data How to Create an Excel Waterfall Chart. To put it another way PVIFA is a number that represents the present value of the payment series.

In 2010 corporate tax revenue constituted about 9 of all federal revenues or 13 of GDP. Cumulative Annuity Payments - A line chart that displays the annuity payments cumulatively. This can be re written as.

Heres a chart I put together highlighting the values of a 35000 and 50000 pension in the range of the most common pension amounts. Annuity Plans - Know types advantages disadvantages benefits of annuity plans. They provide the value now of 1 received at the end of period n at a discount rate of i.

The last value in this line chart should equal the Total Cash Flow mentioned above.

Appendix Pv Tables Of Present Values Advanced Accounting 5th Edition Book

Present Value Of An Annuity How To Calculate Examples

Lottery Winner S Dilemma Lump Sum Or Annuity

Present Value Of Annuity Formula With Calculator

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Annuity Tables Double Entry Bookkeeping

Annuity Formula What Is Annuity Formula Examples

What Is An Annuity Table And How Do You Use One

Present Value Annuity Table Formulas Calculator Basic Accounting Help

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

What Is An Annuity Table And How Do You Use One

Present Value Of Annuity Due Formula Calculator With Excel Template

How To Calculate The Present Value Of An Annuity Youtube

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of An Ordinary Annuity Of 1 Download Table

Solved Table 6 Present Value Of An Annuity Due Of 1 1 I Chegg Com

Appendix Present Value Tables Financial Accounting